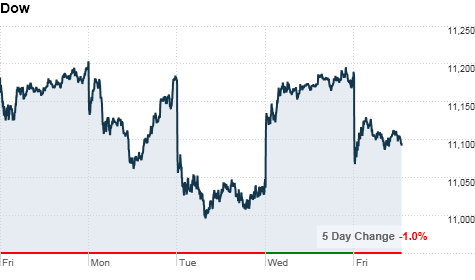

Stocks: A rollercoaster week

Click chart for more market action.

Click chart for more market action.NEW YORK (CNNMoney.com) -- U.S. stocks went on a wild ride this week, with the Dow posting triple-digit losses one day and triple-digit gains the next.

A fresh round of selling erupted on Friday as worries about Europe's debt crisis intensified, overshadowing an early frenzy of Black Friday shopping.

For the week, the Dow slipped 1% and the S&P 500 fell 0.9%, while the Nasdaq managed to end 0.7% higher.

On Friday, the Dow Jones industrial average (INDU) dropped 95 points, or 0.9%; the S&P 500 (SPX) fell 9 points, or 0.8%; and the Nasdaq (COMP) dipped 9 points, or 0.3%.

With many investors out for the Thanksgiving holiday week, trading volume was more than 30% lighter than usual, said Chip Brian, founder or SmarTrend. And thin trading tends to lead to exaggerated market moves.

All U.S. markets were dark Thursday and closed at 1 p.m. ET Friday.

"To the extent there's anyone around, it's all concerns about Europe," said Dan Greenhaus, chief market strategist with Miller Taback & Co. "The state of the consumer is also important but won't be known immediately, so that's taking a backseat to what's going on in Europe."

Ireland's agreement last weekend to accept a bailout package helped soothe investors' nerves Wednesday. But on Friday, Standard & Poor's slashed the credit ratings of Anglo Irish Bank, the Bank of Ireland, Allied Irish Banks and Irish Life & Permanent, saying the creditworthiness of the four banks had weakened.

Shares of the Bank of Ireland (IRE) sank 11%, while Allied Irish Bank (AIB) shares slipped 6%.

And now other euro zone nations are raising red flags.

"Portugal is already in many investors' minds as needing a bailout, and the focus is now on whether Spain needs one too and if so, how large is the package that they need," said Greenhaus.

Portugal Telecom (PT) edged down about 2%, while shares of Spanish bank Banco Santander (STD) fell 5%.

The selling spilled over to U.S. banks. Shares of Citigroup (C, Fortune 500), Wells Fargo (WFC, Fortune 500), Bank of America (BAC, Fortune 500), and JPMorgan Chase (JPM, Fortune 500) finished more than 1% lower.

All Dow components but one ended the session in the red, with International Business Machines (IBM, Fortune 500), Hewlett- Packard (HPQ, Fortune 500) and Chevron (CVX, Fortune 500) among the biggest losers.

With no economic reports or corporate results on tap, investors were also keeping an eye on the volatile situation on the Korean peninsula and China's efforts to avoid an economic crash landing by curbing bank lending.

World markets: European stocks posted losses. Britain's FTSE 100 ended 0.5% lower, the DAX in Germany dropped 0.5%, and France's CAC 40 dipped by 0.8%

Asian markets also ended lower. The Shanghai Composite slipped 0.9%, the Hang Seng in Hong Kong dropped 0.8%, and Japan's Nikkei lost 0.4%.

Currencies and commodities: The dollar surged against the euro, the Japanese yen and the British pound.

Oil for January delivery slipped 11 cents to settle at $83.76.

Gold futures for December delivery dropped $18 to $1,355.

Bonds: The price on the benchmark 10-year U.S. Treasury dropped, pushing the yield up to 2.87%.

http://money.cnn.com/2010/11/26/markets/markets_newyork/index.htm?hpt=T2

Tidak ada komentar:

Posting Komentar